Oh man, you've got your sights set on a new ride! But, should you buy or lease that car you've been thinking about? It can be a tough decision, but don't you fret, we've got all the pros and cons to help you make the right choice!

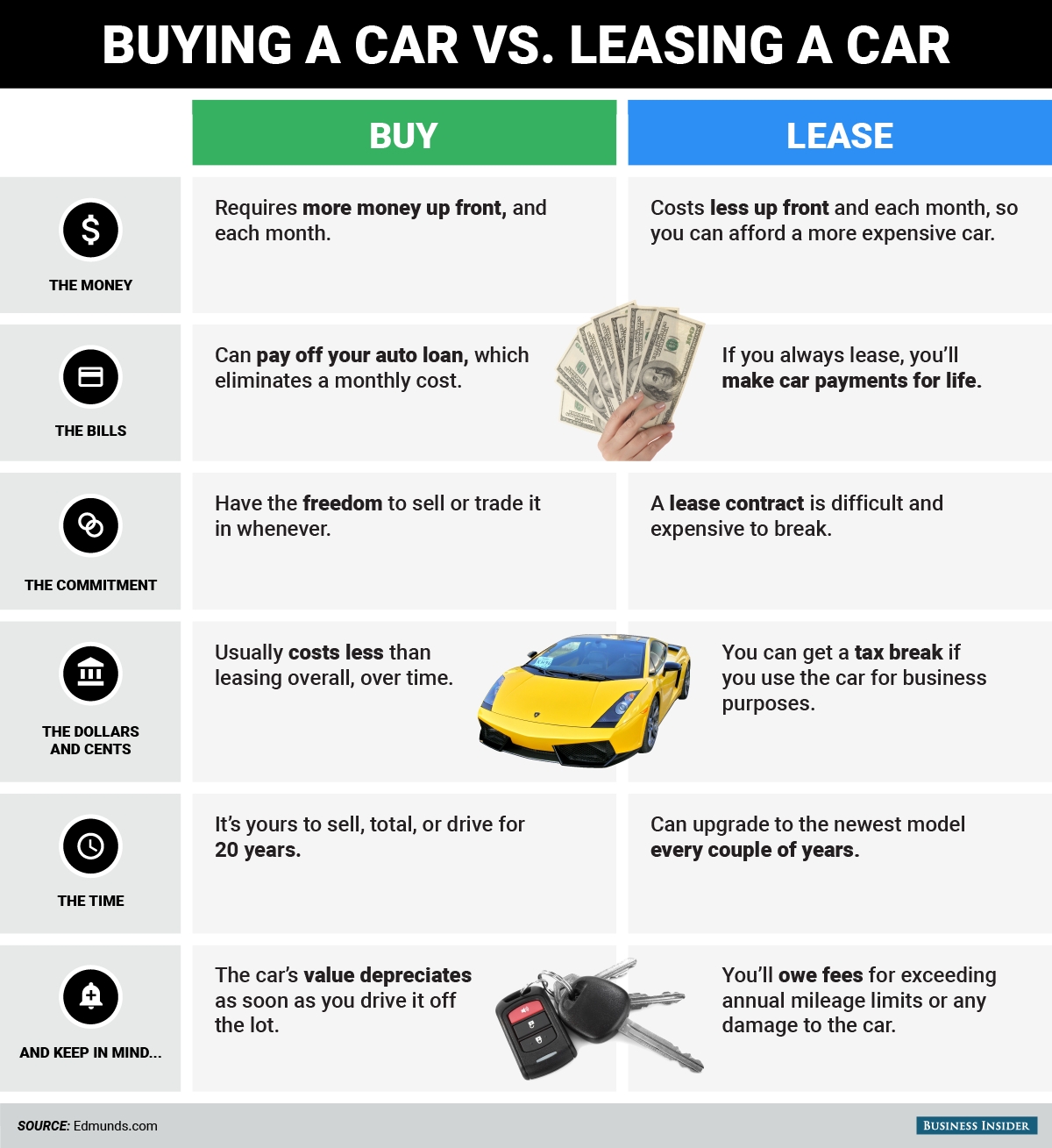

Leasing vs Buying

Pros of Leasing

Leasing a car can certainly have its perks. Here are some of the advantages:

- Lower monthly payments: Because you're only paying for the depreciation of the car over the length of the lease, your monthly payments can be much lower than if you were buying the car outright.

- Warranty coverage: Typically, most cars are leased for a period that covers the manufacturer's warranty. This means that if anything goes wrong with the car during that time, you won't have to foot the bill for any repairs.

- Flexibility: Leasing a car can be a great option if you like to switch up your ride frequently. Once your lease is up, you can simply return the car and lease a new one.

Cons of Leasing

As with anything, there are also some downsides to leasing a car:

- No equity: When you lease a car, you're essentially paying to rent it for a certain period of time. This means that you won't have any equity in the car once your lease is up like you would if you bought it outright.

- Restrictions: When you lease a car, there may be restrictions on how many miles you can put on it each year. If you go over that limit, you could face additional fees.

- Damage fees: If you return the car with any damage beyond normal wear and tear, you could face additional fees.

Auto Insurance When Leasing A Car

Your car insurance policy will generally work in the same way whether you're leasing or buying a car. However, there are a few things to keep in mind when leasing a car:

- You'll likely be required to have a certain amount of liability insurance with higher limits than if you were buying the car outright.

- You may also be required to have gap insurance, which covers the difference between the value of the car and the amount you owe on your lease if the car is totaled or stolen and not recovered.

- Keep in mind that you'll typically have to pay a higher premium for a leased car compared to a car you own outright.

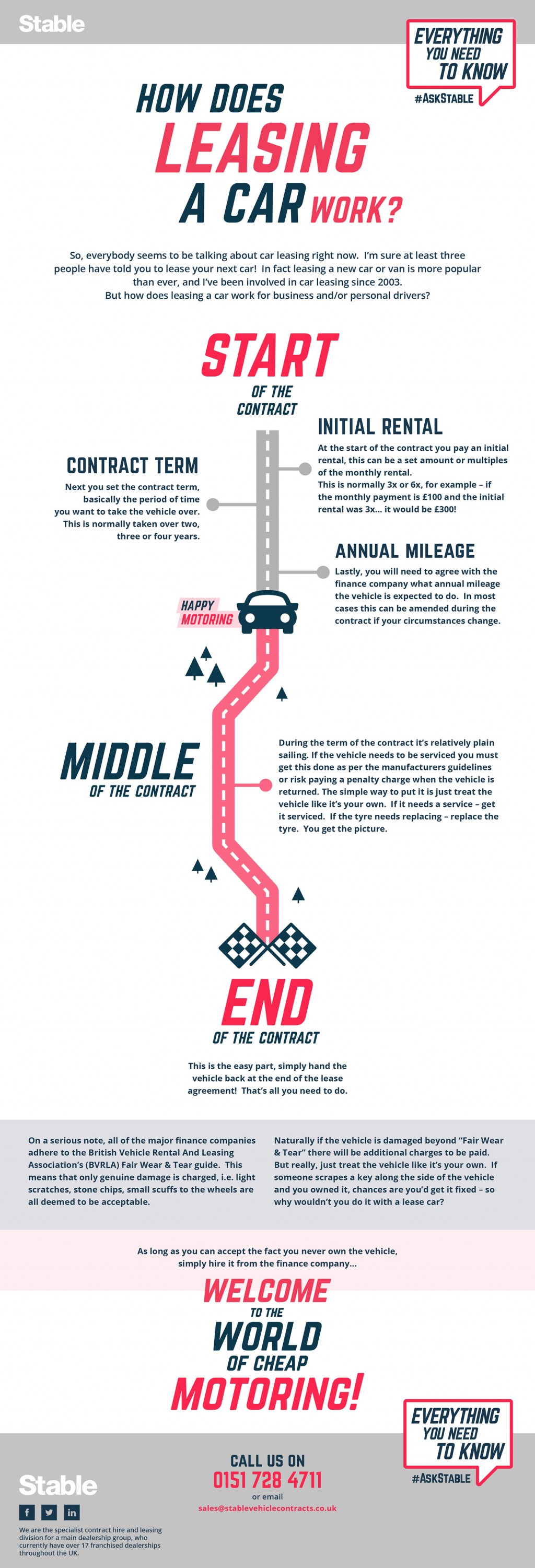

How Does Leasing A Car Work?

So, now that you know the pros and cons of leasing a car, how does the whole process work?

- You'll typically need to make a down payment, which is usually a few thousand dollars, depending on the car and the terms of your lease.

- You'll then make monthly payments over the length of your lease, which is usually 2-4 years.

- At the end of your lease, you'll have a few options: you can return the car and walk away, you can buy the car outright, or you can lease a new car.

When Do You Pay Deductible Car Insurance?

When it comes to your car insurance policy, your deductible is the amount you'll pay out of pocket before your insurance kicks in. Here are a few things to keep in mind:

- You'll typically pay your deductible if you're in an accident and your car needs repairs.

- If you have comprehensive or collision coverage, you'll also pay your deductible if your car is stolen or damaged in a non-collision event like a hailstorm.

- Keep in mind that the amount of your deductible can have a big impact on your monthly premium, so it's important to choose a deductible that you can comfortably afford to pay out of pocket if needed.

So there you have it - all the ins and outs of leasing vs buying a car, and some tips for insuring your leased car and paying your car insurance deductible. Now it's up to you to decide which option makes the most sense for your situation. Happy car shopping!

View more articles about Insurance When Leasing A Car