When To Start Social Security - There are many factors to consider when it comes to deciding when to start receiving Social Security retirement benefits. Your specific financial situation, lifestyle preferences, health status, and life expectancy can all play a role in when you should begin receiving benefits. To help you make an informed decision, we've compiled some useful tips and advice on when to start Social Security.

How to Apply for Social Security:

Step-by-Step Guide

If you're nearing retirement age, it's important to know how to apply for Social Security benefits. Applying for benefits is a straightforward process, but there are several factors you need to keep in mind to ensure you maximize your benefits. Here's a step-by-step guide to help you get started:

Step 1: Determine Your Eligibility

The first step in applying for Social Security benefits is to determine if you're eligible. You must be at least 62 years old to apply, and you must have worked and paid into Social Security for a certain number of years to qualify. You can check your eligibility by logging into your Social Security account or by contacting your local Social Security office.

Step 2: Gather Required Documents

Once you've determined your eligibility, you'll need to gather the required documents to complete your application. This includes your Social Security card, birth certificate or other proof of citizenship or lawful residency, and your most recent tax return or W-2 form. You'll need to provide original or certified copies of these documents, so make sure you have everything you need before you apply.

Step 3: Apply for Benefits

You can apply for Social Security retirement benefits online, by phone, or in person at your local Social Security office. The online application process is the fastest and most convenient, but you can also apply by calling 1-800-772-1213 or by scheduling an appointment at your local office.

Step 4: Review and Submit Your Application

After you've completed your application, review it carefully to ensure you've provided accurate and complete information. Once you're satisfied with your application, submit it online, by phone, or in person. You'll receive a confirmation number that you can use to check the status of your application.

Will My Social Security Benefits Start Automatically?

What You Need to Know

Many people assume that their Social Security retirement benefits will start automatically when they turn 62, but that's not always the case. Depending on your specific situation, you may need to take action to begin receiving benefits. Here's what you need to know:

Automatic Enrollment

If you're already receiving Social Security disability benefits, your retirement benefits will start automatically when you reach full retirement age. Full retirement age is currently 66 for people born between 1943 and 1954, and it gradually increases to 67 for people born in 1960 or later. If you're not receiving disability benefits, you may need to take action to begin receiving retirement benefits.

When to Start Benefits

When you begin receiving Social Security retirement benefits can have a significant impact on the amount you receive each month. If you start benefits at age 62, your monthly benefit will be lower than if you wait until your full retirement age. On the other hand, if you wait until age 70 to start benefits, your monthly benefit will be higher. Consider your financial needs and life expectancy when deciding when to start benefits.

When Should I Start Taking Social Security?

Factors to Consider

Deciding when to start taking Social Security retirement benefits can be a complex decision. Here are some factors to consider when making your decision:

Financial Needs

If you need the income from Social Security to cover your basic living expenses, it may make sense to start taking benefits as soon as possible. However, if you have other sources of income or you're able to continue working, you may want to delay benefits.

Life Expectancy

If you anticipate living a long life, you may want to delay taking benefits to receive a higher monthly benefit. On the other hand, if you have health issues or a family history of shorter life expectancies, it may make sense to start taking benefits sooner.

Spousal Benefits

If you're married, you may be eligible for spousal benefits based on your spouse's earnings record. Consider your spouse's age and earnings when deciding when to start benefits.

Tax Implications

Social Security benefits may be subject to federal income tax, depending on your total income. Consider the tax implications of starting benefits at different ages.

By taking these factors into account, you can make an informed decision about when to start receiving Social Security retirement benefits. If you're nearing retirement age, start planning now to ensure you make the most of your benefits.

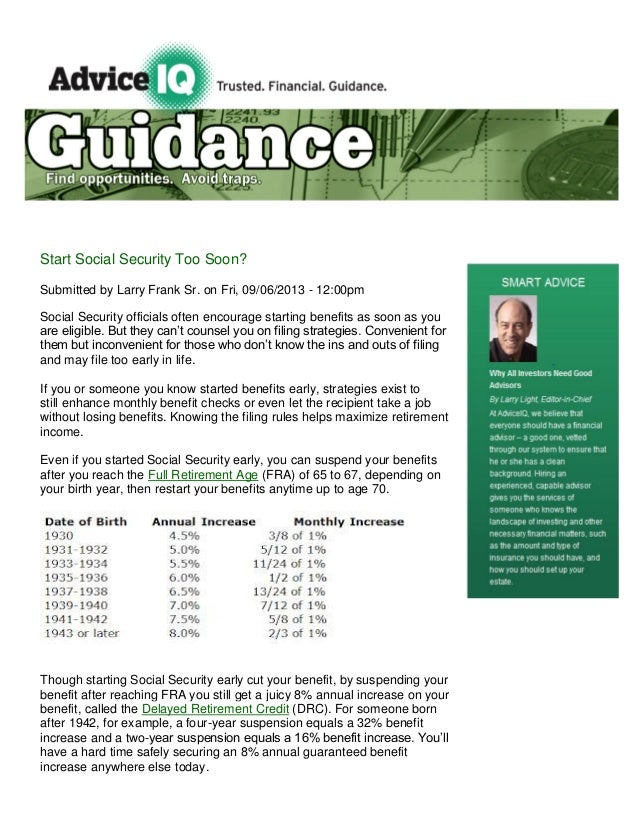

Advice on Starting Social Security Too Soon

Why It May Not Be a Good Idea

Some people may be tempted to start taking Social Security retirement benefits as soon as they turn 62, but that may not be the best decision for everyone. Here's why:

Reduced Monthly Benefits

If you start taking Social Security retirement benefits at age 62, your monthly benefit will be reduced by up to 30% compared to what you would receive at full retirement age. This reduction is permanent and can have a significant impact on your retirement income.

Long-Term Financial Planning

Taking Social Security retirement benefits too soon can also impact your long-term financial planning. If you anticipate living a long life, delaying benefits can help ensure you have enough income to cover your expenses. On the other hand, if you start benefits too soon, you may run out of money later in life.

Other Sources of Income

If you have other sources of retirement income, such as a pension or IRA, you may be able to delay taking Social Security benefits and maximize your overall retirement income. Consider all of your retirement income sources when deciding when to start Social Security.

Conclusion

Deciding when to start taking Social Security retirement benefits is an important decision that can have a significant impact on your retirement income. Take the time to consider your financial needs, life expectancy, and other factors to make an informed decision. By starting early, gathering necessary documents, and seeking guidance when you need it, you can ensure that you get the most out of your Social Security benefits.

View more articles about When To Start Social Security