When it comes to taxes, there are a lot of questions that come up. How much money do you have to make to file taxes? When can you file your taxes? How long do you have to file your taxes? And if you don't have a Social Security number, can you still file your taxes? Here, we'll dive into everything you need to know about taxes and how to file them.

How Much Money Do You Have to Make to File Taxes?

RefundTalk.com

RefundTalk.com

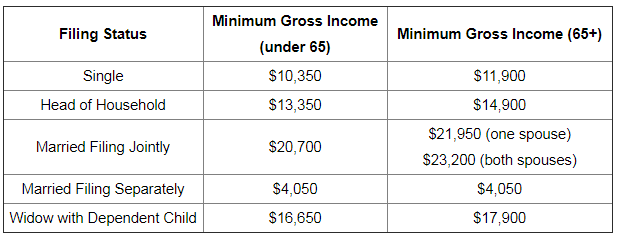

Many people wonder, "Do I even need to file taxes?" The answer depends on a few factors, but the most important one is how much money you make. If you're single and under 65, you need to file taxes if your income is over $12,400. If you're married and filing jointly, the number jumps to $24,800. These numbers change if you're over 65 or if you have children, so it's important to do some research or work with a tax professional to make sure you're filing correctly.

When Can I File Taxes?

Insider

Insider

When can I file taxes? The answer is generally around mid-January. The exact date changes every year, but the IRS typically starts accepting tax returns in the last two weeks of January. However, if you want to get a head start, you can start preparing your taxes as soon as you have all of your tax documents, which should start arriving in late December or early January.

How Long Can I Take to File Taxes?

Global Tax

Global Tax

If you can't file your taxes by the standard tax deadline (usually April 15th, but it can vary), don't panic. You have an automatic extension until October 15th to file your taxes. However, if you owe taxes, you'll need to pay at least 90% of your tax liability by the original due date to avoid any penalties or interest. If you need more time than that, you can apply for an extension, but keep in mind that an extension to file doesn't mean an extension to pay. You'll still need to estimate and pay what you owe by the original deadline.

Can You File Your Taxes in the US Without a Social Security Number?

AOTax

AOTax

If you don't have a Social Security number, you can still file a tax return using an Individual Taxpayer Identification Number (ITIN). You'll need to apply for an ITIN and provide some documentation to prove your identity and foreign status. Keep in mind that if you're working in the US, your employer may still require you to have a Social Security number for tax withholding purposes, even if you file your tax return with an ITIN.

Now that you know some basics about taxes, here are a few tips and ideas to help make filing your taxes a little easier:

Tips and Ideas for Filing Your Taxes

- Start early so you have plenty of time to gather all of your tax documents and ask any questions you might have.

- Keep good records throughout the year so you don't have to scramble to find everything come tax time.

- Consider working with a tax professional to make sure you're taking advantage of all available deductions and credits and that you're filing correctly.

- If you owe taxes, don't ignore the problem. Reach out to the IRS as soon as possible to set up a payment plan or explore other options.

- Finally, if you're due a refund, consider e-filing and opting for direct deposit to get your money as quickly as possible.

Filing your taxes can be a daunting process, but it doesn't have to be. By understanding the basics of taxes and following some tips and ideas, you can make tax time a little more manageable.

View more articles about When Can I File Taxes